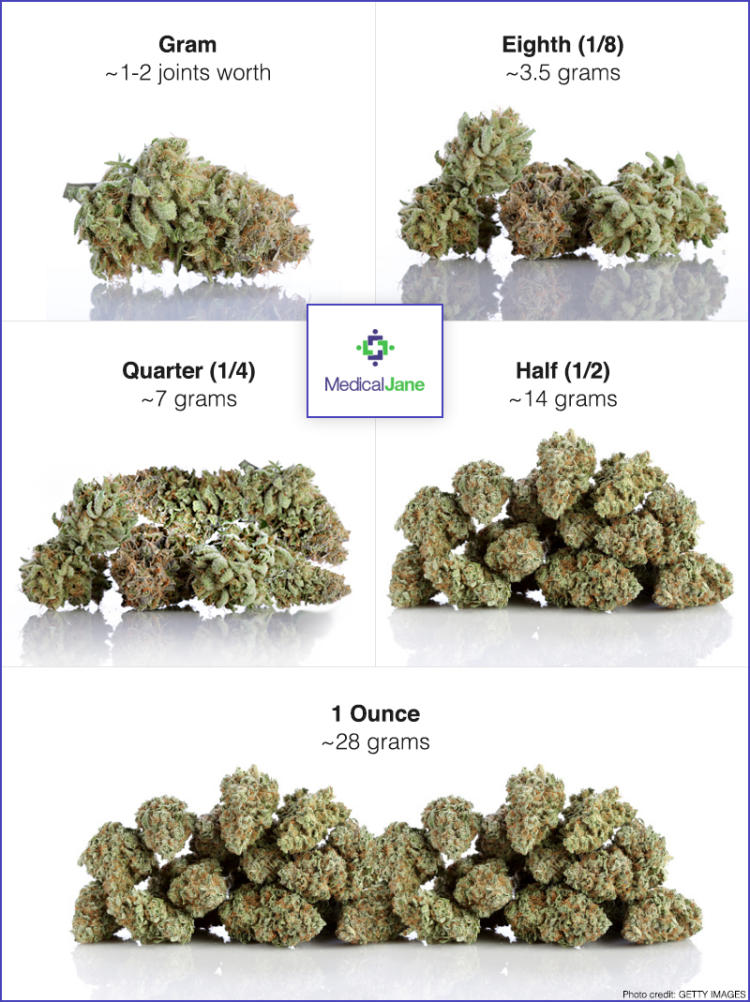

Size to Weight - A visual reference for nug weight

ACBFF Stock: Has the Aurora Stock Price Hit Rock Bottom?

https://www.profitconfidential.com/stock/aurora-cannabis-stock/acbff-stock-aurora-stock-price-rock-bottom/

ACBFF Stock: Has the Aurora Stock Price Hit Rock Bottom?

When it comes to marijuana stocks, it is hard to find a stranger story than Aurora Cannabis Inc (OTCMKTS:ACBFF, TSE:ACB). ACBFF stock dropped by 48% in the last six months. However, Aurora stock might be approaching an inflection point.

https://www.profitconfidential.com/wp-content/uploads/2018/08/acbff-stock-tumble-300x169.jpg

[caption id="attachment_132251" align="alignleft" width="300"]

When it comes to marijuana stocks, it is hard to find a stranger story than

(OTCMKTS:ACBFF, TSE:ACB). The Vancouver-based company spent billions of dollars on acquisitions, choosing to swallow rivals and build market share rather than build its own production facilities.

And yet, ACBFF shares dropped by 48% in the last six months.

It was an extraordinary vanishing act. The bigger Aurora became, the faster its share price crashed. However, we may be nearing an inflection point.

Below, I'll outline what critical factors are driving Aurora stock and how the company can leverage these numbers through the remainder of 2018.

Bear in mind that Aurora is in penny-stock territory. It is trading at around $4.66 for the first time since Q4 last year.

Remember, however, that the Canadian government will officially legalize recreational marijuana in that country in October. Demand will surge. And cannabis stocks? All their carefully laid plans will come crashing down in a mad scramble for market share.

It’s at this time that size begins to matter.

Aurora is one of the Big Three—along with

(OTCMKTS:APHQF, TSE:APH)—which means it could achieve economies of scale before smaller rivals can. It has a massive advantage.

But first, let’s discuss what went wrong with Aurora stock.

Aurora Cannabis did not crash alone. In Q1 2018, an industry-wide correction drained almost all marijuana stocks of their value. Even the big ones, like Canopy Growth and Aphria, fell nearly as much as Aurora.

But then their paths diverged. Canopy and Aphria soared as the market recovered, while Aurora remained stuck in the mud. Why?

In November 2017, Aurora began an ambitious plan to take over the Canadian market. It spent $4.3 billion on two prominent buyouts, one of which became a fiasco (the

The company's debt-to-equity ratio is 15.9, meaning that it paid for its growth using a credit card. The company also opened a $200.0-million credit facility with the

(NYSE:BMO), suggesting that it will continue to strain its balance sheet.

Typically, companies with high debt levels are cash-positive. They rake in the dough and then pass it on to creditors. Not only does this keep the company in business, but it prevents it from issuing more stock—a move that would dilute the value of existing shares.

But you need cash flow to pull this off. Aurora did it when marijuana was still illegal, when sales were close to zero. Given that lack of revenue, it’s hardly surprising that investors dumped the stock.

But that’s about to change.

In Canada, marijuana will be legal on October 17, 2018. Demand from Europe is rising fast too, at least with regards to medical marijuana and cannabidiol (CBD) oils. Aurora might finally gain the cash flow to secure its operations.

Plus, Aurora has:

Completed its $1.1-billion acquisition of CanniMed. (Source: "

Aurora Cannabis and MedReleaf Close the World's Largest Cannabis Industry Transaction

Nearly completed construction of a 1,000,000-square-foot facility in Denmark.

I should add that Aurora is not overvalued in terms of assets. It has grow-ops and processing factories to compete with almost anyone. That was never the problem. The issue was cash flow, debt, and whether the company was spending beyond its means.

The fact remains that investors are deeply afraid of Aurora’s financial position. I personally think you can capitalize on that fear, because once marijuana legalization kicks into gear, Aurora could be making money hand over fist.

It’s like the company has a life-saving drug that is being reviewed by the U.S. Food & Drug Administration (FDA). Once it is approved (which, in this analogy would be on October 17), sales could explode.

The current state of marijuana legalization only precipitates matters.

Canada has, to be sure, embraced recreational cannabis from coast to coast, but the United States is stuck in a detente between pro-marijuana state governments and an anti-drug federal government. Each state that legalizes in the future is a trigger point for Aurora stock.

From experience, I can tell you that size plays a big role in these situations. Aurora can use its market share and pricing power to bully smaller competitors.

TSLA Stock Analysis: Should Investors Stick With Tesla or Take the Buyout at $420?

Marijuana Stocks: 3 Stocks to Profit From Big Alcohol-Marijuana Partnerships

Cryptocurrency News: Vitalik Buterin Doesn't Care About Bitcoin ETFs

ACBFF Stock: Has the Aurora Stock Price Hit Rock Bottom?

When it comes to marijuana stocks, it is hard to find a stranger story than

(OTCMKTS:ACBFF, TSE:ACB). The Vancouver-based company spent billions of dollars on acquisitions, choosing to swallow rivals and build market share rather than build its own production facilities.

And yet, ACBFF shares dropped by 48% in the last six months.

It was an extraordinary vanishing act. The bigger Aurora became, the faster its share price crashed. However, we may be nearing an inflection point.

Below, I’ll outline what critical factors are driving Aurora stock and how the company can leverage these numbers through the remainder of 2018.

Bear in mind that Aurora is in penny-stock territory. It is trading at around $4.66 for the first time since Q4 last year.

Remember, however, that the Canadian government will officially legalize recreational marijuana in that country in October. Demand will surge. And cannabis stocks? All their carefully laid plans will come crashing down in a mad scramble for market share.

(OTCMKTS:APHQF, TSE:APH)—which means it could achieve economies of scale before smaller rivals can. It has a massive advantage.

But first, let’s discuss what went wrong with Aurora stock.

Aurora Cannabis did not crash alone. In Q1 2018, an industry-wide correction drained almost all marijuana stocks of their value. Even the big ones, like Canopy Growth and Aphria, fell nearly as much as Aurora.

But then their paths diverged. Canopy and Aphria soared as the market recovered, while Aurora remained stuck in the mud. Why?

In November 2017, Aurora began an ambitious plan to take over the Canadian market. It spent $4.3 billion on two prominent buyouts, one of which became a fiasco (the

The company’s debt-to-equity ratio is 15.9, meaning that it paid for its growth using a credit card. The company also opened a $200.0-million credit facility with the

(NYSE:BMO), suggesting that it will continue to strain its balance sheet.

Typically, companies with high debt levels are cash-positive. They rake in the dough and then pass it on to creditors. Not only does this keep the company in business, but it prevents it from issuing more stock—a move that would dilute the value of existing shares.

But you need cash flow to pull this off. Aurora did it when marijuana was still illegal, when sales were close to zero. Given that lack of revenue, it’s hardly surprising that investors dumped the stock.

In Canada, marijuana will be legal on October 17, 2018. Demand from Europe is rising fast too, at least with regards to medical marijuana and cannabidiol (CBD) oils. Aurora might finally gain the cash flow to secure its operations.

Completed its $1.1-billion acquisition of CanniMed. (Source: “

Aurora Cannabis and MedReleaf Close the World’s Largest Cannabis Industry Transaction

Nearly completed construction of a 1,000,000-square-foot facility in Denmark.

I should add that Aurora is not overvalued in terms of assets. It has grow-ops and processing factories to compete with almost anyone. That was never the problem. The issue was cash flow, debt, and whether the company was spending beyond its means.

The fact remains that investors are deeply afraid of Aurora’s financial position. I personally think you can capitalize on that fear, because once marijuana legalization kicks into gear, Aurora could be making money hand over fist.

It’s like the company has a life-saving drug that is being reviewed by the U.S. Food & Drug Administration (FDA). Once it is approved (which, in this analogy would be on October 17), sales could explode.

The current state of marijuana legalization only precipitates matters.

Canada has, to be sure, embraced recreational cannabis from coast to coast, but the United States is stuck in a detente between pro-marijuana state governments and an anti-drug federal government. Each state that legalizes in the future is a trigger point for Aurora stock.

From experience, I can tell you that size plays a big role in these situations. Aurora can use its market share and pricing power to bully smaller competitors. Marijuana Scale Chart And Prices

...when you opt-in for our daily e-letter, Profit Confidential and the special offers that come with it!

This is FREE from Profit Confidential. You can unsubscribe at any time.

FireEye Stock: Why This Cybersecurity Company Could Stage a Major Rally

Appian Stock: Strong Growth Supports Upcoming Breakout

Napco Security Technologies Stock: An Aggressive Micro-Cap IoT Play with Good Prospects

Aurora Cannabis Stock: Why This Weed Play Could Easily Double

Altra Industrial Motion Stock: Look for a Rally If Tariff Risk Falls

TSLA Stock Analysis: Should Investors Stick With Tesla or Take the Buyout at $420?

Marijuana Stocks: 3 Stocks to Profit From Big Alcohol-Marijuana Partnerships

Cryptocurrency News: Vitalik Buterin Doesn’t Care About Bitcoin ETFs

California’s 3 Best Marijuana Penny Stocks Under $5

Did Elon Musk’s Tweets Jeopardize the Tesla Inc Share Price?

This Is Why DDD Stock Is Geared Toward Higher Prices

Is CannaRoyalty Stock Destined to Break Out Toward Higher Prices?

Marijuana Stocks: ICC Stock Is on the Cusp of Making a Bullish Move

ROKU Stock Is on the Brink of Breaking Out Toward Higher Prices

DOCU Stock Poised to Go Up on This Growing Technology Trend

Alarm.com Stock: The Smart Home Stock With Double-Digit Upside

Marijuana News Today: Drug Breakthrough Huge Boon for Medical Marijuana

Marijuana News Today: U.S. Marijuana Market to Expand in November

MedMen Sales Revenue Marks It as a Retail Marijuana Stock on the Rise

Marijuana News Today: Marijuana Industry Poised to Overtake Alcohol

TLRY Stock Forecast: No Overvaluation Seen in the Tilray Stock Price Marijuana Scale Chart And Prices

Marijuana Scale Chart And Prices ,000% in 2017, This Cryptocurrency May Be the Next Ripple

How to Store Monero (XMR): Best Wallets and Reviews

Bitcoin Gold Price Prediction: 2 Reasons Why BTG Will Sustain in the Crypto Market

5 Tech Stocks That Could Boom Under the Trump Presidency

Will Tesla Make You Rich Like the Ford Shareholders of 1903? Marijuana Scale Chart And Prices

0 Reviews:

Post Your Review